SpotLoan has gained recognition as an online lending platform, often considered an alternative to traditional payday loans. However, like any financial service, it comes with its own set of advantages and drawbacks. This article provides an in-depth review of SpotLoan, highlighting its services, benefits, drawbacks, and more.

SpotLoan is a digital lending company owned by BlueChip Financial, a tribal entity governed by the laws of the Turtle Mountain Band of Chippewa Indians of North Dakota. Offering short-term personal loans with fixed payments, SpotLoan positions itself as a more manageable alternative to traditional payday loans.

SpotLoan operates under the authority of a sovereign nation other than the United States. This tribal status allows them to operate outside of certain federal or state laws, such as North Dakota’s interest rate limit. However, this tribal standing has been contested, and their compliance with standard legal requirements remains a subject of investigation.

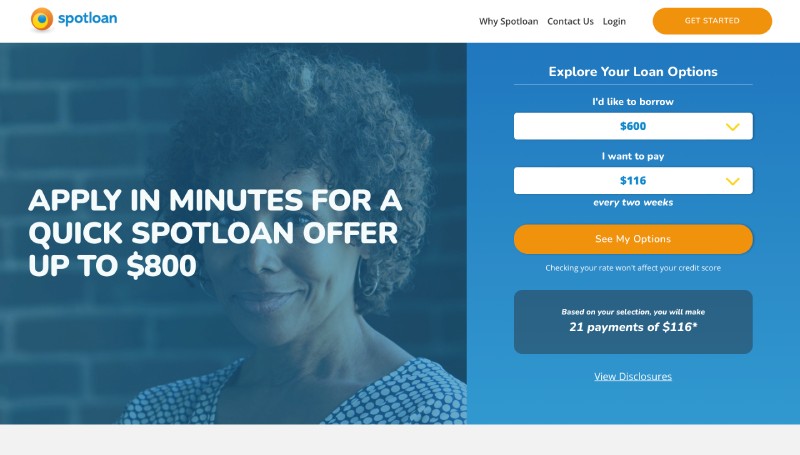

SpotLoan offers personal loans ranging from $300 to $800, with repayment terms of up to 10 months. Unlike conventional payday loans that require full repayment on the borrower’s next payday, SpotLoan allows borrowers to pay back their loans in several installments.

One of the crucial factors to consider while applying for a SpotLoan is its high Annual Percentage Rate (APR). Depending on your loan terms, your APR with SpotLoan could go as high as 490%, significantly higher than what most other personal loan lenders offer.

SpotLoan extends loans to individuals rebuilding their credit. While your credit score will be considered during the application process, SpotLoan also considers other factors, making it possible for individuals with bad credit to secure a loan.

Here are some additional elements to consider when evaluating SpotLoan.

SpotLoan may be a viable option for those facing emergency expenses and seeking a short-term installment loan, especially if traditional payday loans or title loans pose too much risk. However, if you have good credit or need a larger loan amount, it’s recommended to explore other lenders.

To apply for a SpotLoan, visit their website and fill out an online application. The application will require personal information, employment details, and bank account details. Approved applicants can receive funds as soon as the same day or within two business days.

If SpotLoan does not seem to be the right fit for you, consider other online loans like SpotLoan such as:

While SpotLoan offers an alternative to traditional payday loans with flexible repayment terms, its high APR makes it a costly option. As with any financial decision, it’s crucial to read the terms thoroughly and ensure the loan fits within your budget.

Spotify revealed an update to its app on Wednesday that will allow users to have… Read More

Check out the best wheelchair-accessible date ideas in Denver, Colorado, and how planning ahead ensures… Read More

Smart cards, with their embedded microchips, enable secure data storage and processing, playing a vital… Read More

The world's top local commerce platform, DoorDash (NASDAQ: DASH), announced today that it has signed… Read More

Spotify has begun to show how many times each podcast episode has been listened to… Read More

The Men's IIHF Ice Hockey World Championship in 2025 is expected to be one of… Read More