Business

Kudi and Onepipe’s Partnership Set to Provide Financial Access to Millions of Customers in Underserved Areas Of Nigeria

It’s no longer news that at the moment, nothing is falling faster than the Naira against currencies like the Dollar, Pounds, and Euros, and the ripple effect is how hard the economic situation in Nigeria is hitting on the citizens, especially the average Nigerian who would be required to own a tangible asset to apply for a bank loan. Difficult is the word that best describe the process of accessing loans in Nigeria in the past.

In fact, there was nothing called ‘Instant Loans’ until the emergence and boom of the FinTech industry, as companies like OnePipe are leveraging on technology to meet the daily financial needs of the average Nigerian who even though deserve a strong financial net, can’t seem to access it.

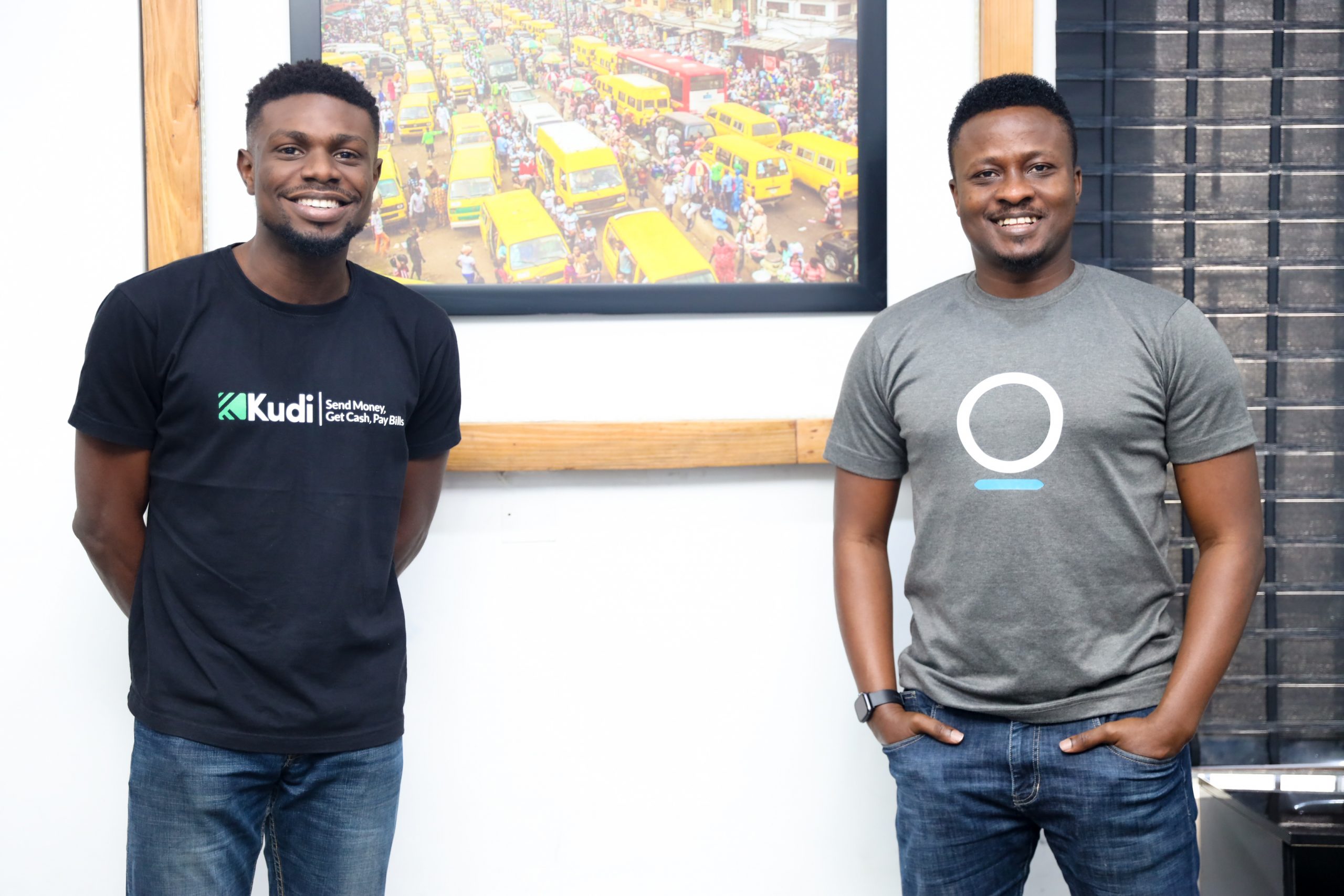

Fintech infrastructure startup, OnePipe has partnered with Polaris Bank and Kudi, a payments service company to provide more inclusive financial services to millions of people across Nigeria. Interestingly, this is a no interest loan, contrary to what many Nigerian commercial banks offer.

Founded in 2018, OnePipe, leveraging its API-driven partnerships, is focused on working with organisations to embed and launch financial services like accounts, improved payments and credit within their products. OnePipe’s CEO, Ope Adeoye reiterated the need for incumbent financial services stakeholders to combine resources with innovators to ensure that underserved Nigerians are included into the digital financial ecosystem. In his words “the collaboration of Polaris Bank, Migo, Zitra investments, Kudi and of course OnePipe has birthed the value proposition driving the Kudi benefits account.”

Polaris via its digital banking platform, Vulte, facilitates the provisioning of full-fledged, regulatory compliant accounts, MIGO and Zitra Investments provide the lending resources and all of these are stitched together via OnePipe’s versatile gateway resulting in Kudi Benefits Account – A NUBAN enabled account that provides services and benefits for Kudi’s unique customer base.

Speaking on this partnership, Kudi’s CEO, Yinka Adewale said “it is important to us to continue to explore various channels to drive financial access to every Nigerian regardless of who they are or where they live. Leveraging on OnePipe’s infrastructure, partnership with Polaris Bank and others, we can now provide full utility, NUBAN bank accounts laced with a no-friction credit proposition via kudibenefits.chat, and very soon will be issuing debit cards to millions of users and thereby, expanding our service offerings to them.”

According to a recent EFInA report, over 38 million Nigerian adults still do not have access to digitized financial services. This highlights the need for an improved effort to drive financial inclusion in Nigeria and more innovative ways to solve this problem. OnePipe’s aim is to ensure that every average Nigerian has an access to instant loans, from as little as around $10 to huge sums. Kudi Benefit is setting the pace and bridging the gap between the average Nigerian and the financial industry in terms of access to loans.

With the right resources, partnerships and collaborations, a solid foundation can be formed, on which significant solutions systems are built. This is why Kudi benefit has a blueprint that has been properly mapped out and designed to ensure that resources put in by investors work exactly as anticipated and projected numbers return in an efficient and effective manner. A 2-way beneficial system is the goal and critical positive reception to this innovative intervention shows that the numbers are looking good.

Onepipe’s collaboration with Kudi is set to deepen the financial access to millions of users who already rely on Kudi’s payment service to withdraw cash, send cash and pay their bills through its fast-growing network of over 50,000 Mobile Money Agents across Nigeria. Growth is inevitable when access is guaranteed, and that access is what those who sign up with Kudi can look forward to. From the regular areas to the underserved parts of every location across Nigeria, the arrival of Kudi Benefit is about to change the loan access game, from Nigeria, all the way across West Africa.

In conclusion, this innovative solution also opens up another fantastic option for investors who are looking to widen their returns channel(s) in the fast-growing FinTech sector, or those even looking to invest for the very first time. Pipeone and Kudi’s collaboration inevitably spells an impeccable opportunity for those who can make calculative projections and grab such investment opportunities. It is one that several financial enthusiasts have claimed would not only benefit the public, but also fast-acting, savvy investors.

-

Sports4 weeks ago

Sports4 weeks agoFIFA Club World Cup 2025: Complete List of Qualified Teams and Groups

-

Sports3 weeks ago

Sports3 weeks agoAl Ahly vs Inter Miami, 2025 FIFA Club World Cup – Preview, Prediction, Predicted Lineups and How to Watch

-

Health2 weeks ago

Back to Roots: Ayurveda Offers Natural Cure for Common Hair Woes

-

Tech2 weeks ago

Tech2 weeks agoFrom Soil to Silicon: The Rise of Agriculture AI and Drone Innovations in 2025

-

Sports3 weeks ago

Sports3 weeks agoFIVB Men’s Volleyball Nations League 2025: Full Schedule, Fixtures, Format, Teams, Pools and How to Watch

-

Startup3 weeks ago

Startup3 weeks agoHow Instagram Is Driving Global Social Media Marketing Trends

-

Television4 weeks ago

Television4 weeks agoTribeca Festival 2025: Date, Time, Lineups, Performances, Tickets and How to Watch

-

Sports3 weeks ago

Sports3 weeks agoWorld Judo Championships 2025: Full Schedule, Date, Time, Key Athletes and How to Watch