Cryptocurrency

US Backed Digital Currency, is it happening? By Nibras Muhsin, QA Engineer | MBA | Blockchain Professional

How would the US-Backed Digital Currency Change Transactions Globally?

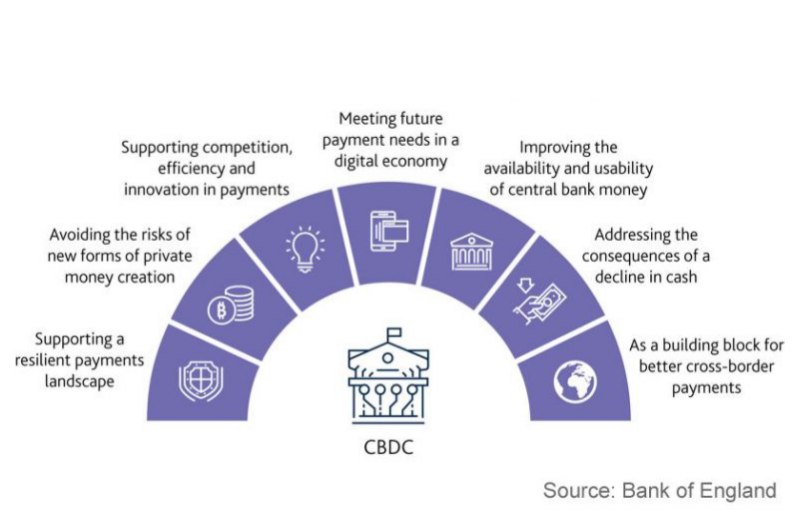

As the USD currency is the worldly accepted reserve globally, a digital US-backed currency will probably become the world’s DIGITAL reserve currency. Below are some possible scenarios,

There are many unbanked people globally therefore, the introduction of virtual currencies will see many of them embracing the New Digital currencies and opening virtual accounts. The rate of transactions we are witnessing right now could be too minute compared to what might happen.

We will also witness cheap, enhanced, and faster transactions, eliminating many bottlenecks that are associated with the current Fiat Currency. The transactions would be continuous, anytime, any day, and anywhere. Another issue would be diminishing usage of cash and accelerated usage of Digital currencies globally.

The format would also change, seeing many middle financial institutions losing big. Since it would be linked directly to central banks, users will link their digital wallets to CBs (Central Banks). Most people might opt-in depositing their money directly to central banks. It would see many middle financial entities diversifying their portfolios or even shifting from banking to other ventures (Cox, 2021).

The Effect of the Digital Currency on the Fees Charged by banks?

Several things are for sure, the digital currency would disrupt the entire financial system. Some of the areas would be intermediation format, exchange rate, deposit, stability, and payment system operations. There would be reduced transactional fees that banks rely on, due to reduced deposits, and withdrawals. The banks’ financial stability would be in jeopardy. On the other hand, individual users will benefit big as they might witness reduced transactional fees owing to the elimination of various intermediaries (Baer, 2021).

What CBDC Means to Decentralized Cryptocurrencies such as Bitcoin

Though people have argued that the Emergence of US-Backed digital currency could see the end of decentralized currency such as Bitcoin, currently, there is no tangible proof to that effect. We might witness the opposite of the above in that since CBDCs are coming to enforce regulations on blockchain-based transactions, we could see more people gravitating to cryptocurrencies to avoid government surveillance. The two vary in the administrative nature, CBDCs are centralized whereas crypto is decentralized. The more regulations are put in place, the more time taken to transact or open an account could deter many people from investing in CBDCs thereby opting to Cryptocurrencies. Another factor could be the value issue. Whereas a US-backed Currency could be pegged at the current rate of the USD, cryptocurrencies such as Bitcoin will have an upper hand due to their value. This could see more people investing in crypto.

However, if the CBDCs are intended to eliminate the crypto through stringent regulations, then there is a chance of seeing a diminished usage of Crypto. We could also see a scenario where short-term investors might prefer investing in CBDCs that are stable and have got government backing. It is a wait-and-see game to see what happens to Cryptocurrencies (Sucks, 2020).

Is it Important for the US to move faster than Global Competitors in Implementing CBDCs?

Though the DC could have several merits rushing its implementation could be hazardous. It could see many traditional depositors withdrawing money amass thereby destabilizing banks and the country’s economy as a whole. Another critical aspect is the backlash the digital currency could bring. Some of the risks could be cybersecurity risks and money laundering.

With the US being the world monetary caretaker, it is important to take time in studying the new currency would be challenged before implementation. Tracking cross border usage could prove a challenge if proper infrastructure is not in place (Council, 2021)

References:

Baer, G. (2021). Central Bank Digital Currencies: Costs, Benefits and Major Implications for the U.S. Economic System. FinTech & Innovation.

Council, A. (2021, April 20). The Rise of Central Bank Digital Currencies. GeoEconomics Program and Belfer Center for Science and International Affairs.

Cox, J. (2021, April 19). Wall Street banks brace for digital dollars as the next big disruptive force. Retrieved from https://www.cnbc.com/2021/04/19/central-bank-digital-currency-is-the-next-major-financial-disruptor.html

Sucks, A. (2020, May 7). Central Bank Digital Currencies and Impact on Bitcoin. Medium.com.

-

Sports4 weeks ago

Sports4 weeks agoFIFA Club World Cup 2025: Complete List of Qualified Teams and Groups

-

Sports3 weeks ago

Sports3 weeks agoAl Ahly vs Inter Miami, 2025 FIFA Club World Cup – Preview, Prediction, Predicted Lineups and How to Watch

-

Health2 weeks ago

Back to Roots: Ayurveda Offers Natural Cure for Common Hair Woes

-

Tech2 weeks ago

Tech2 weeks agoFrom Soil to Silicon: The Rise of Agriculture AI and Drone Innovations in 2025

-

Sports3 weeks ago

Sports3 weeks agoFIVB Men’s Volleyball Nations League 2025: Full Schedule, Fixtures, Format, Teams, Pools and How to Watch

-

Startup3 weeks ago

Startup3 weeks agoHow Instagram Is Driving Global Social Media Marketing Trends

-

Television4 weeks ago

Television4 weeks agoTribeca Festival 2025: Date, Time, Lineups, Performances, Tickets and How to Watch

-

Sports3 weeks ago

Sports3 weeks agoWorld Judo Championships 2025: Full Schedule, Date, Time, Key Athletes and How to Watch