Startup

Tips for 20s and 30s Young Professionals to Become Financial Independence

Graduating students’ top priority is landing a job, even as college campuses hum with placement activities. But once you receive that first paycheck, it’s just as important to be wise with money. For young professionals starting their financial journey in their 20s and 30s, we have provided advice in this guide.

Investing in equities:

Set aside some of your income, particularly early in your career, to invest in stocks. Financial experts advise investing 60–80% in stocks to take advantage of the potential for long-term returns.

Smart living in metro cities:

Do you reside in an expensive metropolis like Bengaluru or Mumbai? Acquire money-saving tips, like initiating a mutual fund systematic investment plan (SIP) and escalating contributions annually.

Financial assets over real estate:

When you were younger, consider investing in financial assets instead of real estate. This increases financial freedom by offering flexibility for job changes, career transitions, or relocations.

Discipline in spending:

Spend sensibly, especially when purchasing luxuries. Financial strain can result from impulsive spending, particularly on non-essential items. Sort needs from wants and don’t take on more debt than you need.

Smart borrowing

It makes sense to borrow money for a home or an education, but exercise caution when making unnecessary purchases. Stay away from high-interest loans for things you don’t need because they can lower your credit score.

Emergency corpus:

Create an emergency fund that is three to six times your monthly income or expenditures. For a well-rounded financial portfolio, mix regular SIPs in debt funds with investments in equity funds.

Health insurance:

Make health insurance a top priority for hospital stays or medical expenses while ill. Even if your employer covers part of your medical expenses, you still need personal insurance.

Setting long-term financial goals:

Identify necessary funds, list long-term goals, and set aside a part of your salary to simplify your financial plan. Avoid shortcuts and concentrate on sustainable financial practices.

Expert advice:

Consult a mutual fund distributor or an investment advisor registered with SEBI for advice. While customized portfolios can be obtained through online platforms, working directly with an advisor can help you better navigate market fluctuations.

With these pointers, you can start your financial journey and ensure that your 20s and 30s will be secure and independent.

-

Travel4 weeks ago

Travel4 weeks agoBwindi’s Gorilla Tourism: Saving Wildlife, Empowering Communities

-

Education4 weeks ago

Education4 weeks agoJoseph Curran: Using Legal Writing and Advocacy to Simplify Complex Issues for Clients

-

Tech4 weeks ago

Tech4 weeks agoGoogle Offers New Travel-related Features To Search And Launches Its AI “Flight Deals” Tool Around The World

-

Business4 weeks ago

Business4 weeks agoStop the Bleeding: How Unanswered Comments Increase Your CAC

-

Cryptocurrency2 weeks ago

Cryptocurrency2 weeks agoRami Beracha Asks, Can Israel Become A Global Leader In Blockchain Innovation?

-

Tech3 weeks ago

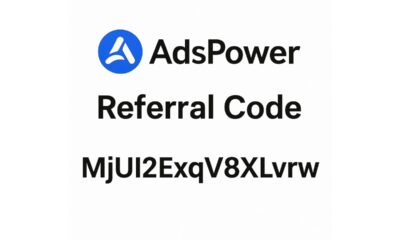

Tech3 weeks agoAdsPower Promo Code for 50% Off – Ultimate Guide to AdsPower Benefits (Referral Code Included)

-

Education2 weeks ago

Education2 weeks agoForged in Fire: Nicholas Lawless Unveils Lawless Leadership – The Model Built for a World That Traditional Leadership Can’t Survive

-

Business2 weeks ago

Business2 weeks agoOPO Group LTD Strengthens Its Global Footprint With Expanding Offices and a Modernized Trading Ecosystem