News

How to and Who qualifies for President Joe Biden’s new student loan forgiveness plan

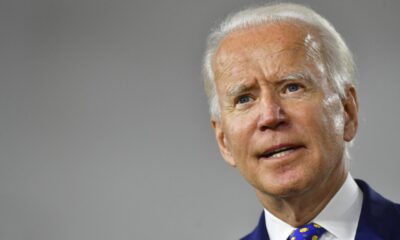

President Joe Biden on Wednesday announced his plan to address student loan debt, which incorporates debt forgiveness for specific borrowers and expanding the pandemic-related payment pause.

The Biden administration has proactively dropped almost $32 billion of the $1.6 trillion in exceptional federal student debt by growing existing forgiveness programs for public-sector laborers, debilitated borrowers, and students who were defrauded by for-profit colleges.

Here are details learned of Biden’s new plan, including how much will be pardoned and who is qualified.

Who qualifies?

The plan applies to federal student loan borrowers.

How much forgiveness will they get?

How much debt dropped relies upon whether the borrower got a Pell grant to go to college. A federal Pell grant is simply given to undergraduate students who”display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree” and “does not have to be repaid, except under certain circumstances,” as per the Department of Education’s Federal Student Aid office. Per information referred to by the White House, Pell gives at present just covers a third of the expense of a four-year public college degree, which has led to expanded borrowing.

Finding the Right Student Loan Consolidation Service

Individual borrowers who make under $125,000 yearly and married couples or heads of households who make under $250,000 yearly will have up $10,000 of their federal student loan debt excused on the off chance that they didn’t get a Pell grant as an undergrad student, per the FSA website.

Individual borrowers who make under $125,000 yearly and married couples or heads of households who make under $250,000 yearly who got a Pell grant as undergraduate students will have up $20,000 of their student loan debt forgiven.

What steps do qualified borrowers need to take?

Almost 8 million borrowers might have the option to get debt automatically naturally in light of the fact that the Department of Education as of now has their pay data, FSA says.

The Biden administration will launch an application before long for borrowers to turn out their revenue data or on the other hand assuming that borrowers are uncertain in the event that the department has their pay data as of now. The application will be accessible by early October, a senior administration official told. After a borrower finishes the application, the individual can expect the student loan help within four to six weeks, the official likewise said.

To be notified when the application is open, borrowers can sign up at studentaid.gov.

FSA says the application will be accessible before the federal student loan repayment pause closes on December 31. Borrowers are advised to apply before November 15 to get alleviation before the repayment pause expires, however, the Department of Education will keep on handling applications even after the pause expires, the official noted.

Borrowers can sign up for updates on when the application is open at the Department of Education’s subscriptions page.

How might future repayments for remaining debt work?

The student loan repayment will be paused in the future until December 31, 2022, with repayments beginning in January 2023.

The Biden administration is likewise proposing a rule to make another pay-driven repayment plan in which borrowers pay something like 5% of their month-to-month pay on undergraduate loans, a decrease from the ongoing 10% threshold.

The rule would likewise increase how much pay is thought of as “non-discretionary income” so no borrower procuring below 225% of the federal poverty level should make a monthly payment.

For borrowers with loan balances of $12,000 or less, loan balances would be forgiven following 10 years of payments rather than the ongoing 20-year mark, under the proposed new income-driven repayment plan.

Furthermore, to assist with keeping a borrower’s loan balance from developing while the singular makes monthly payments, under the proposed rule the Biden administration would cover unpaid month-to-month interest, regardless of whether the monthly payment is $0 because of the borrower’s income level.

-

Sports4 weeks ago

Sports4 weeks agoFIFA Club World Cup 2025: Complete List of Qualified Teams and Groups

-

Sports3 weeks ago

Sports3 weeks agoAl Ahly vs Inter Miami, 2025 FIFA Club World Cup – Preview, Prediction, Predicted Lineups and How to Watch

-

Health1 week ago

Back to Roots: Ayurveda Offers Natural Cure for Common Hair Woes

-

Tech2 weeks ago

Tech2 weeks agoFrom Soil to Silicon: The Rise of Agriculture AI and Drone Innovations in 2025

-

Sports3 weeks ago

Sports3 weeks agoFIVB Men’s Volleyball Nations League 2025: Full Schedule, Fixtures, Format, Teams, Pools and How to Watch

-

Science4 weeks ago

Science4 weeks agoEverything You Need to Know about Skywatching in June 2025: Full Moon, New Moon, Arietid Meteors, and Planetary Marvels

-

Startup3 weeks ago

Startup3 weeks agoHow Instagram Is Driving Global Social Media Marketing Trends

-

Television4 weeks ago

Television4 weeks agoTribeca Festival 2025: Date, Time, Lineups, Performances, Tickets and How to Watch