Business

Nvidia offers a solid revenue outlook on demand for computer chips in its fourth-quarter

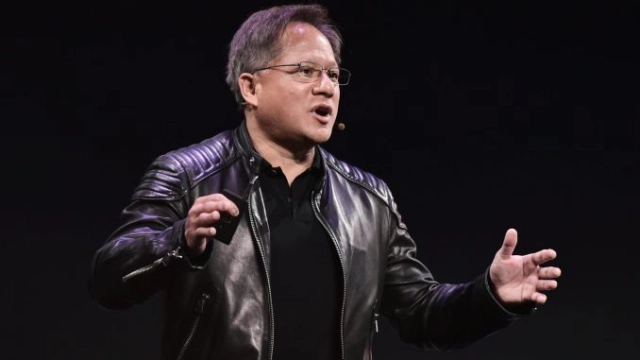

Nvidia detailed fourth-quarter earnings and sales on Wednesday that beat investigator expectations and gave a solid outlook to the current quarter. The stock fell around 2% in broadened trading. Nvidia Corp. was given a solid forecast notwithstanding supply imperatives Wednesday, after doubling benefits and creating record sales in the holiday quarter.

This is the way the chipmaker did versus Refinitiv agreement expectations for the quarter finishing January:

- EPS: $1.32, adjusted, versus $1.22 expected, up 69% year-over-year.

- Revenue: $7.64 billion, versus $7.42 billion expected, up 53% year-over-year.

Nvidia said it hopes to report revenue of $8.1 billion in the first quarter, higher than investigator expectations for $7.29 billion. Nvidia CEO Jensen Huang said in a statement that the organization is seeing “exceptional” demand because its chips are valuable for artificial intelligence and other escalated applications.

Huang additionally said Nvidia’s supply requirements were facilitating and that the organization’s supply of products would increment “substantially” in the second half of 2022.

Nvidia’s stock mobilized in 2021, yet it is down around 10% up until this point this year as investors are searching for more secure investments in an inflationary climate.

Nvidia has gotten a lift as cloud suppliers and enterprises turn to its graphics processors that are used for artificial intelligence applications like speech recognition and suggestions. Nvidia announced $3.26 billion in sales from its data center business, up 71% annually.

During the quarter, Nvidia declared that Facebook parent Meta would involve its chips for AI research, for example.

Gaming is as yet Nvidia’s biggest market, as its most recent GeForce graphics processors are great for playing advanced computer games. The gaming business rose 37% year-over-year to $3.42 billion driven by GeForce sales, the organization said.

Nvidia’s chips are additionally used by businesses for applications like computer-assisted design and rendering. It reports those sales in its Professional Visualization business, which rose 109% annually to $643 million. The organization said the development was driven by workstation chip sales and hybrid working.

Be that as it may, Nvidia’s automotive business was down 14% to $125 million. It’s anything but an essential concentration for the organization yet represents a development market for its chips. Nvidia said that car creators’ supply imperatives were one explanation that its automotive sales fell.

Nvidia said nearly all of its GPUs presently transport with software that keeps them from being used to mine cryptocurrency and that miners can purchase specific mining processors instead. It said it sold $550 million in crypto-specific cards in fiscal 2022 and just $24 million in the fourth quarter.

In an indication of how Nvidia is exploring supply chain issues, the organization said it had $9 billion in long-term supply commitments, up from $2.54 billion every year prior.

“We expect supply to improve each and every quarter going forward,” Huang said on a call with experts.

Nvidia was in converses with buy chip technology organization Arm from SoftBank, however, the organization declared earlier this month that the transaction had fallen apart under regulatory scrutiny.

“We gave it our best shot,” Huang said. “But the headwinds were too strong.”

Nvidia said it expected a $1.36 billion charge to operating costs because of the Arms deal failing to close.

-

Sports4 weeks ago

Sports4 weeks agoFIFA Club World Cup 2025: Complete List of Qualified Teams and Groups

-

Sports3 weeks ago

Sports3 weeks agoAl Ahly vs Inter Miami, 2025 FIFA Club World Cup – Preview, Prediction, Predicted Lineups and How to Watch

-

Health1 week ago

Back to Roots: Ayurveda Offers Natural Cure for Common Hair Woes

-

Tech2 weeks ago

Tech2 weeks agoFrom Soil to Silicon: The Rise of Agriculture AI and Drone Innovations in 2025

-

Sports3 weeks ago

Sports3 weeks agoFIVB Men’s Volleyball Nations League 2025: Full Schedule, Fixtures, Format, Teams, Pools and How to Watch

-

Startup3 weeks ago

Startup3 weeks agoHow Instagram Is Driving Global Social Media Marketing Trends

-

Television4 weeks ago

Television4 weeks agoTribeca Festival 2025: Date, Time, Lineups, Performances, Tickets and How to Watch

-

Sports3 weeks ago

Sports3 weeks agoWorld Judo Championships 2025: Full Schedule, Date, Time, Key Athletes and How to Watch