Business

General Motors upgraded its outlook, outperformed estimates, and projected an EV unit to make a “variable profit” by the end of the year

General Motors (GM) maintained the momentum in its earnings with impressive first-quarter results on Tuesday. The automaker also increased its full-year guidance and stated that it continues to see “positive variable profit” in its electric vehicle business in the second half of 2024.

According to Bloomberg data, GM reported top-line revenue of $43.0 billion for the quarter, exceeding the $42.09 billion analysts had projected. That matched the $43 billion in sales from the previous quarter and represented an increase of 7% over the same period last year.

With adjusted EBIT (earnings before interest and taxes) of $3.9 billion, the company reported adjusted earnings per share of $2.62, above estimates for $2.12. GM exceeded estimates for its Q1 operating profit by $3.7 billion, coming in at $3.12 billion.

GM’s shares rose 5% in early trading after the results were announced

The company raised its 2024 guidance as a result of GM’s impressive performance. The company’s previous outlook of $12 billion to $14 billion has been revised to a full-year adjusted EBIT of $12.5 billion to $14.5 billion. The revised estimate for adjusted earnings in 2024 is $9.00–$10.00 per share; GM’s full-year EPS was previously estimated to be between $8.50 and $9.50.

GM increased the range of its projected automotive operating cash flow to $18.3 billion to $21.3 billion as well as the adjusted automotive free cash flow to $8.5 billion to $10.5 billion.

“As we continue to strengthen our ICE portfolio, scale EVs, and reinvest in the business, we are very focused on capital efficiency, enhancing profitability and free cash flow, and we will continue to take steps to create shareholder value,” Mary Barra, the CEO of GM, said in a shareholder letter.

During a media call with reporters, GM CFO Paul Jacobson stated that raising GM’s guidance in the wake of its “strong” first quarter was “the right thing to do.”

Additionally, according to Jacobson, GM’s clientele has “been remarkably resilient in a period of higher interest rates.”

GM’s forecast for EVs and total Q1 sales

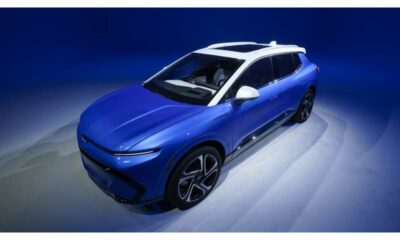

GM reaffirmed that it expects “positive variable profit” in the second half of 2024 from its electric vehicle business, based on a forecast of between 200,000 and 300,000 EVs sold by year’s end.

The company projects a 60-point increase in the EV business’s EBIT margin between 2023 and 2024, and when the impact of clean energy tax credits is taken into account, it predicts a “mid-single digit EBIT margin” by 2025.

Because of lower battery and module costs, the Cadillac LYRIQ EV is now $12,000 less expensive to produce than it was a year ago, according to Jacobson during the analyst call. As a result, GM expects to see an improvement in contribution margin from its EVs in the future. According to Jacobson, GM will be able to “harness savings” in the second and third years of production for certain EVs thanks to scale effects.

GM had previously given up on producing 400,000 electric vehicles by the middle of 2024. Regarding EV sales, Barra stated in the analyst conference call that GM is “always going to be responsive to the customer,” echoing what Jacobson stated during the media call that GM will “pace ourselves with the customer.”

Through the use of the conventional gas-powered business’s strength, Barra stated in her letter that the company was able to gradually expand its electric vehicle business while maintaining “strong margins and cash flows.”

Thanks to lower fleet sales, General Motors (GM) reported Q1 US sales that exceeded estimates but were lower than a year earlier. While retail sales increased by 6%, GM’s vehicle deliveries decreased by 1.5% to 594,233 units.

During the first quarter, GM claimed to have delivered more cars than any other US automaker.

GM announced significant advancements in the EV market with the Cadillac LYRIQ, Hummer EV, and Silverado EV. Previously only offered to fleet customers, Silverado EV deliveries to retail customers are scheduled to start in “the coming months,” according to the company.

A software glitch caused sales of Chevrolet’s Blazer EV to stop, but they resumed in March. Despite this, the vehicle only sold 500 units during the quarter. Prices for the much-awaited Equinox EV start at about $35,000 when sales of the vehicle begin later in the second quarter.

After the cars were put back on the road, Barra stated that GM is resuming operations at its autonomous driving unit, Cruise, in the Phoenix area. After a pedestrian accident and additional incidents involving its autonomous vehicles, Cruise suspended all operations in the previous year.

-

Health3 weeks ago

Back to Roots: Ayurveda Offers Natural Cure for Common Hair Woes

-

Tech3 weeks ago

Tech3 weeks agoFrom Soil to Silicon: The Rise of Agriculture AI and Drone Innovations in 2025

-

Science1 week ago

Science1 week agoJuly Full Moon 2025: Everything You Should Need to Know, When and Where to See Buck Moon

-

Sports3 weeks ago

Sports3 weeks agoFIBA 3×3 World Cup 2025: Full Schedule, Preview, and How to Watch

-

Gadget4 weeks ago

Gadget4 weeks agoThings to Know about Samsung Galaxy S26: What’s New and What’s Next

-

Tech4 weeks ago

Tech4 weeks agoAdobe Firefly App Now Available on iOS and Android Phones to Create AI Images and Videos Anywhere

-

Sports2 weeks ago

Sports2 weeks agoPrefontaine Classic 2025: Full Schedule, Preview, Field, Events and How to Watch Diamond League Eugene Live

-

Festivals & Events4 weeks ago

Festivals & Events4 weeks agoEverything You Should Need to Know about Summer Solstice 2025