Business

Torobanc Review Unveils the Services and Features of this Brokerage

Explore this comprehensive Torobanc review to gain insights into the offerings of this brokerage firm. Learn about account types, security, and more.

Torobanc Review Lists Pros And Cons of the Broker

This Torobanc review aims to provide an impartial overview of the web broker’s services, catering to those seeking factual information for informed decision-making. Before delving into the specifics of Torobanc, let’s establish what a web broker is.

A web broker is an online platform that facilitates trading across various financial markets, offering access to stocks, commodities, cryptocurrencies, and forex. These platforms serve as intermediaries, enabling individuals to execute trades and manage their investments efficiently.

Now, turning the focus to Torobanc, it is a prominent online broker founded by seasoned financial experts with a mission to democratize access to global financial markets.

The broker’s user-friendly platform is designed to cater to traders of all experience levels. The company distinguishes itself by providing a wide array of trading tools, real-time data, advanced analytics, and expert insights. Furthermore, they offer educational resources to help traders enhance their market knowledge and trading skills.

Notably, Torobanc prioritizes security, employing cutting-edge technologies to safeguard client data and funds. Are you curious to learn more about this broker’s services? Read this full review for a detailed overview.

Torobanc Review: Features of the firm

1. Account Types

In this Torobanc review, this part sheds light on the account types offered by the broker and the account opening process. The broker provides a range of account options to cater to varying investor needs, including Basic (€250), Silver (€5,000), Gold (€15,000), Platinum (€100,000), and VIP (€250,000).

To initiate the account opening process with Torobanc, prospective clients should visit the broker’s website and follow the online registration procedure. During this process, individuals will be required to furnish personal and financial details, including the submission of identification documents. Accuracy during registration is essential, as any inaccuracies may result in delays in the account opening process.

It’s crucial for potential clients to carefully consider investment goals and risk tolerance while selecting an account type to ensure it aligns with their financial objectives.

2. Trading Platform

This section of the Torobanc review highlights the broker’s trading platform and its mobile optimization. The broker offers a proprietary trading platform equipped with advanced tools, customizable charts, real-time market data, and rapid order execution. Additionally, they provide access to MT5 terminals and web-based traders, enhancing flexibility for traders.

One notable feature is Torobanc’s dedication to mobile accessibility. Its Mobile friendly feature enables traders to access their accounts and execute trades seamlessly on smartphones and tablets. This mobile optimization ensures that traders can keep checking the markets and managing their positions while on the go, offering convenience and flexibility.

3. Range of Markets

Torobanc offers a diverse range of markets, providing access to various asset classes, including currency pairs, commodities, cryptocurrencies, and shares. Traders can explore a wide spectrum of investment opportunities through Torobanc’s platform.

For those interested in stock trading, this broker facilitates access to both well-established blue-chip stocks and emerging shares. Additionally, the platform offers the convenience of trading cryptocurrencies, encompassing major coins and a multitude of altcoins, eliminating the need for users to set up external wallets.

Moreover, Torobanc caters to commodity enthusiasts, granting access to trading opportunities in energy, agriculture, minerals, and more.

Currency traders can find familiar pairs like USD/GBP/EUR, but Torobanc goes further by offering numerous exotic pairings that might be challenging to find elsewhere.

4. Education Center

In this review of Torobanc, this segment explores the broker’s Education Center, a valuable resource aimed at enhancing traders’ knowledge and skills. This company offers a comprehensive range of educational materials, including video tutorials, webinars, and e-books, designed to empower traders with the necessary tools for informed decision-making.

The video tutorials cover a wide array of topics, such as Fundamental analysis in Forex, Candlestick patterns, Bullish and Bearish Engulfing Patterns, and the basics of Chart Window navigation, among others. These resources provide traders with in-depth insights into various aspects of trading, catering to both beginners and experienced investors

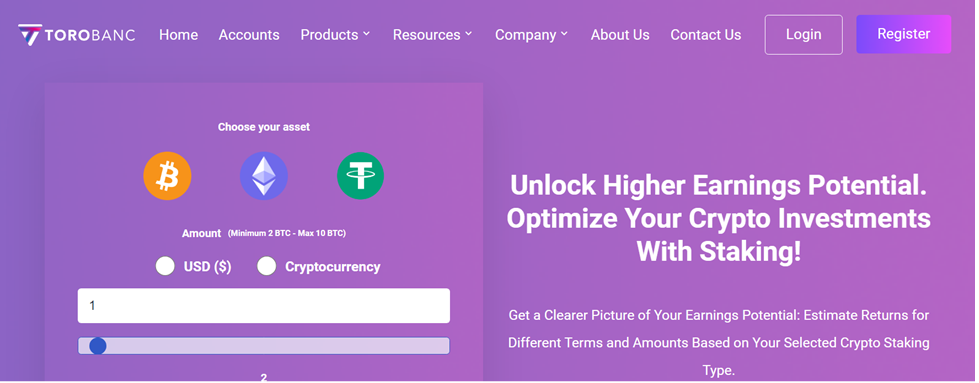

5. Crypto Staking

This part of the Torobanc review delves into the concept of crypto-staking and how the platform facilitates this feature for its clients. Crypto Staking involves investors locking up their cryptocurrencies in a blockchain network to support its security and earn staking rewards beyond the base interest rate. Staked cryptocurrencies remain tradable, offering investors liquidity when required.

Compared to other cryptocurrency investment methods like trading or mining, staking is often considered lower risk due to its reduced exposure to market volatility and lower upfront costs.

Torobanc recognizes the value of Crypto Staking and provides its clients with opportunities to participate in this passive income-generating activity, further expanding the array of investment options available to its user base.

6. Deposit Options

Deposit options refer to the various methods through which clients can fund their accounts with a brokerage firm. These options enable them to choose the most suitable method for their needs.

Torobanc offers a range of deposit methods to accommodate its diverse clientele.

Clients can makedeposits into their accounts using credit/debit cards, enabling quick and straightforward transactions. Additionally, bank transfers are available for those who prefer traditional banking methods, providing a secure way to transfer funds.

For clients looking for a more digital and cryptocurrency-focused approach, Torobanc also supports e-wallets with crypto, allowing for seamless transfers of digital assets.

The brokerage firm understands that different traders have different preferences and requirements when it comes to funding their trading accounts. As such, Torobanc has made sure to provide a selection of deposit methods to accommodate these varying needs.

7. Customer Support

In this Torobanc review, this section explores the customer support services offered by the brokerage firm. It prioritizes client assistance and provides 24/5 customer support to address trader queries and concerns effectively. Clients have access to multiple communication channels, including live chat, email, and phone, ensuring that they can reach out using their preferred method.

One notable aspect of Torobanc’s customer support is the availability of multilingual representatives, catering to a diverse clientele and facilitating communication for traders from various linguistic backgrounds. These representatives are well-equipped to assist traders with a wide range of questions or issues related to their accounts, trading activities, or platform navigation.

Overall, Torobanc’s customer support is responsive and multilingual, which shows that they care about giving their clients a good trading experience and making them happy with the broker’s services.

8. Security

This Torobanc review delves into the security measures implemented by the brokerage firm to safeguard its clients’ funds and data. The platform places a paramount emphasis on the security of its clients’ accounts and transactions, employing strong measures to ensure the safety of their financial assets and sensitive information.

To uphold these security standards, Torobanc collaborates with trusted data partners and maintains stringent protocols at its physical storage locations. These measures are designed to mitigate risks associated with data breaches and unauthorized access, demonstrating the broker’s commitment to maintaining the integrity of its client’s financial information.

Torobanc Review: Limitations of the firm

1. No Trial Account

Torobanc does not offer a trial account, which means potential clients cannot test the platform and its features before going for a live account. This lack of a trial account may pose an inconvenience for traders who prefer a risk-free trial.

2. PayPal is not accepted

Torobanc does not accept PayPal as a deposit method, which could be a limitation for those who rely on PayPal for their financial transactions.

Torobanc Review: Conclusion

In conclusion, this Torobanc review has provided an objective and factual overview of a web broker offering multiple services to traders and investors. Torobanc’s commitment to providing a user-friendly trading platform, diverse market options, educational resources, multiple deposit methods, responsive customer support, and stringent security measures has been highlighted.

Disclaimer: This document is not meant to constitute a recommendation. The author bears no responsibility for any resulting outcomes of the company’s actions during your trading engagement. The information enclosed may lack accuracy or currency. Your trading or financial determinations rest solely with you, and you should not place unwarranted reliance on the information presented. We provide no warranties regarding the contents of this site and assume no liability for trading or investment losses.

-

Sports4 weeks ago

Sports4 weeks agoAl Ahly vs Inter Miami, 2025 FIFA Club World Cup – Preview, Prediction, Predicted Lineups and How to Watch

-

Health3 weeks ago

Back to Roots: Ayurveda Offers Natural Cure for Common Hair Woes

-

Tech3 weeks ago

Tech3 weeks agoFrom Soil to Silicon: The Rise of Agriculture AI and Drone Innovations in 2025

-

Startup4 weeks ago

Startup4 weeks agoHow Instagram Is Driving Global Social Media Marketing Trends

-

Sports3 weeks ago

Sports3 weeks agoFIBA 3×3 World Cup 2025: Full Schedule, Preview, and How to Watch

-

Science4 days ago

Science4 days agoJuly Full Moon 2025: Everything You Should Need to Know, When and Where to See Buck Moon

-

Gadget3 weeks ago

Gadget3 weeks agoThings to Know about Samsung Galaxy S26: What’s New and What’s Next

-

Sports4 weeks ago

Sports4 weeks agoWorld Judo Championships 2025: Full Schedule, Date, Time, Key Athletes and How to Watch