Business

5 Strategies to Maintain Your Family on an Average Salary

Here are five strategies to help you sustain your family on an average salary if you work alone:

1. Review Your Spending Plan

When it comes to managing your monthly expenses and saving money, budgeting is essential. If you discover that you are struggling to make ends meet every month, you might want to review your budget. There may be some categories where you can cut costs completely or where your spending is excessive. Adhering to a more stringent spending plan may even result in surplus funds at the conclusion of each month.

2. Reduce Needless Monthly Charges

Paying unnecessary expenses could be depleting your monthly take-home income. These might be, for instance, automatic monthly payments for streaming services you no longer use. Auto loans or school loans with high interest rates could be additional needless expenses. Reducing (or doing away with) monthly fees that are recurring and refinancing current loans to obtain a cheaper interest rate are two things to think about.

3. Look for Alternative Sources of Additional Income

There are numerous strategies to increase your income if your average pay isn’t enough on its own. You might start a side business by walking dogs, babysitting, or driving for ridesharing services. Alternatively, you may launch your own company or take on occasional freelancing work. One of the most important ways to accumulate wealth is to diversify your sources of monthly income.

4. Employ Your Savings

You are starting off on the right foot if you already have funds. Make sure to transfer any cash savings you may have into a high-yield savings account that pays interest. Compared to traditional brick-and-mortar banks, these internet savings accounts usually offer greater interest rates. Because of the power of compounding, your wealth will increase and your money will be better protected from the ravages of inflation.

5. Adhere to Your Shopping List

Cost of groceries is high. It’s simple—and maybe even tempting—to add a few unnecessary extras to your grocery cart. You may control your spending and stay within your budget by following a weekly grocery list. You may also make a commitment to buy only what’s on sale or the less expensive versions of the things you need.

-

Tech1 week ago

Tech1 week agoAdobe Releases New AI-powered Video Editing Tools for Premiere and After Effects with Significant Motion Design Updates

-

Sports4 weeks ago

Sports4 weeks agoUnited Cup 2026: Full Schedule, Fixtures, Format, Key Players, Groups, Teams, Where and How to Watch Live

-

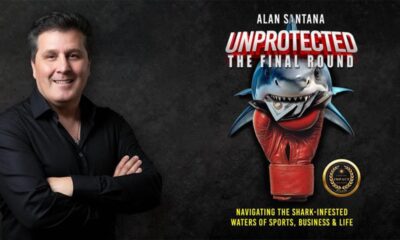

Book4 weeks ago

Book4 weeks agoAuthor, Fighter, Builder: How Alan Santana Uses His Life Story to Empower the Next Generation Through UNPROTECTED

-

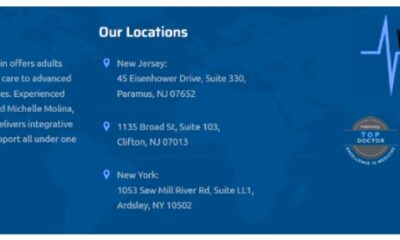

Health4 weeks ago

Health4 weeks agoNew Research and Treatments in Motor Neurone Disease

-

Science4 weeks ago

Science4 weeks agoJanuary Full Moon 2026: Everything You Should Need to Know, When and Where to See Wolf Supermoon

-

Entertainment4 weeks ago

Entertainment4 weeks agoTigerteeh aka Touseef Panchbhaya Drops His Latest Hindi Track “Toxic”

-

Business2 weeks ago

Business2 weeks agoSpartan Capital Publishes 2026 Economic Outlook, Highlighting Volatility, Resilience, and Emerging Opportunities

-

Startup3 weeks ago

Startup3 weeks agoCraig Bonn’s Guide for Spotting a Winning Pre-IPO Early