Business

Europe’s Most Desirable Financial Services Investment Hub is the United Kingdom

The United Kingdom remains the most attractive destination in Europe for foreign direct investment in financial services, as per the latest findings of EY research. Now, thirty-one of these projects are located in the country, an increase of 7% from the previous year.

A foreign direct investment (FDI) is when a company with headquarters in another country makes an investment to acquire a majority stake in a company, a piece of real estate, or a productive asset like a factory in another nation. Before the pandemic, the total value of foreign direct investments (FDIs) fell sharply, reaching a 10-year low in 2018, but it has since rapidly rebounded. For the first time since 2016, the amount of FDIs had already risen to over $2 trillion in 2021.

One of the main countries to benefit from that rallying market is the UK. The UK was ranked as the fifth most desirable location for foreign direct investment (FDI) in the world earlier this year by strategy consulting Kearney, behind the US, Canada, Japan, and Germany. However, a recent analysis by Big Four firm EY indicates that the country’s standing may be even higher in the financial sector.

The UK received 108 financial services projects in 2023, indicating that it has actually tightened its lead over other European FDI markets in that regard, according to EY’s researchers. Its market share increased from 26% in 2022 to 33% by the end of 2023 as a result of the increase from 76 projects in 2022. In contrast, just 12% of Europe’s FDI associated with financial services projects was obtained by rival markets France and Germany combined.

Anna Anthony, EY UK financial services managing partner, commented, “The UK didn’t just maintain its lead as the most attractive European financial services market last year, it extended it significantly. Even through challenging macroeconomic conditions and geopolitical uncertainty, the stability of the UK’s financial services sector has ensured foreign investor confidence remains strong.

The total number of financial services foreign direct investment (FDI) projects in Europe increased by 13% annually to 329 projects in 2023 from 292 projects in 2022. The segment’s growth is indicative of its improving health, as it outpaced the growth of all FDI projects in Europe, which declined by 4% during the same period. This is in contrast to other professional services sectors, like technology and digital and business services, which saw year-over-year declines in project numbers of 19% and 27%, respectively, despite the enormous hype surrounding innovations like artificial intelligence.

In the future, the UK might be in a position to increase that lead even more. In addition to capital inflows from projects that had already been invested in the nation’s financial sector, Britain was the preferred location for the majority of new financial services initiatives. As a result, the UK’s market share of new financial services projects increased from 32% in 2022 to 36% in 2023, the highest level in a decade. The UK recorded 85 new financial services projects in 2023, a 25% increase from the 68 projects in 2022. By contrast, France secured 22 new projects, down from 26 the year before, and Germany attracted 32 new projects, up from 12 in 2022.

The mood was the same across the continent. With an increase of 8% from 215 projects in 2022 to 233 projects in 2023, the number of new financial services projects in Europe reached its highest level since 2019. The UK and the rest of the continent, EY cautioned, may soon face competition for foreign direct investment (FDI) and will need to act swiftly to adapt.

Anthony added, “Competition is fierce – both from European peers and further abroad – and increasing market attractiveness must be a top priority for both industry and government. Efforts to boost attractiveness should build on our strengths and focus on what matters most to investors; including shaping future frameworks to drive innovation, leading on gold-standard regulation, and attracting the best local and international talent.”

-

Travel4 weeks ago

Travel4 weeks agoBwindi’s Gorilla Tourism: Saving Wildlife, Empowering Communities

-

Education4 weeks ago

Education4 weeks agoJoseph Curran: Using Legal Writing and Advocacy to Simplify Complex Issues for Clients

-

Tech4 weeks ago

Tech4 weeks agoGoogle Offers New Travel-related Features To Search And Launches Its AI “Flight Deals” Tool Around The World

-

Business4 weeks ago

Business4 weeks agoStop the Bleeding: How Unanswered Comments Increase Your CAC

-

Cryptocurrency2 weeks ago

Cryptocurrency2 weeks agoRami Beracha Asks, Can Israel Become A Global Leader In Blockchain Innovation?

-

Tech3 weeks ago

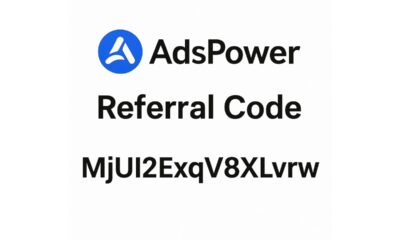

Tech3 weeks agoAdsPower Promo Code for 50% Off – Ultimate Guide to AdsPower Benefits (Referral Code Included)

-

Education2 weeks ago

Education2 weeks agoForged in Fire: Nicholas Lawless Unveils Lawless Leadership – The Model Built for a World That Traditional Leadership Can’t Survive

-

Business2 weeks ago

Business2 weeks agoOPO Group LTD Strengthens Its Global Footprint With Expanding Offices and a Modernized Trading Ecosystem