Business

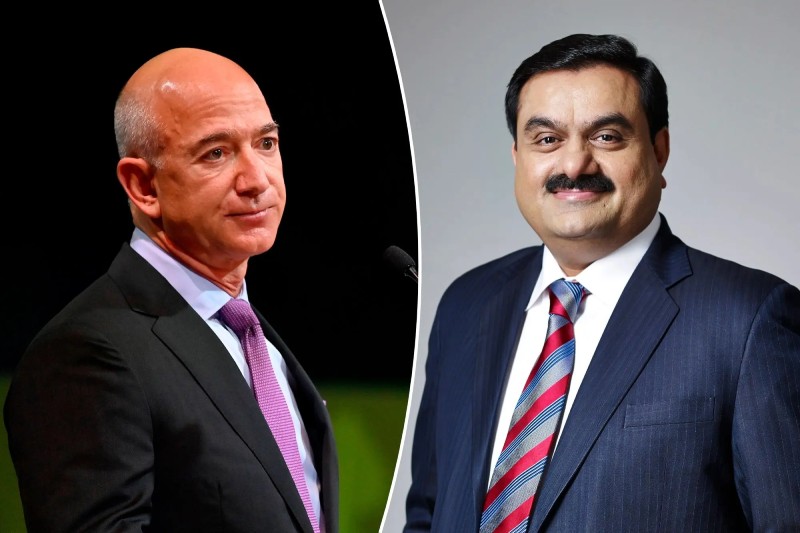

Billionaire Jeff Bezos Loses Spot as World’s Second-Most Richest Person to the Indian mogul Gautam Adani

Gautam Adani, the Indian mogul who has climbed the wealth rankings at breakneck speed this year, outperformed Jeff Bezos to become the world’s second-richest person.

Gautam Adani, who began the year as No. 14 on the Bloomberg Billionaires Index, presently has a $146.8 billion fortune that lingers behind just Elon Musk’s $263.9 billion. Shares of his flagship Adani Enterprises Ltd. surged to a record this week, and some of his group organizations have climbed over 1,000% beginning around 2020.

Jeff Bezos has lost the title of the second richest man in the world behind Elon Musk, electric-vehicle leader Tesla’s (TSLA) CEO.

The founder and executive chairman of tech and online-retail goliath Amazon (AMZN) dropped to No. 3, on Sept. 16 at around 10:38 a.m in New York, as per the Bloomberg Billionaires Index.

Around then, Jeff Bezos had a fortune assessed at $145.8 billion compared with $146.9 billion for the Indian tycoon Gautam Adani who finished the day with a fortune of $147 billion, consequently solidifying his second-place win in the morning. Jeff Bezos has risen a little and is likewise worth generally $147 billion.

The day began with Gautam Adani at No. 3 and Jeff Bezos at No. 2

Jeff Bezos trails Gautam Adani by $19 million as a restored tech selloff Friday again pounded the fortunes of the richest Americans. The change in the wealth rankings could be brief and relies to a great extent upon shares of Amazon.com Inc., which are down 26% this year.

Gautam Adani first overtook India’s Mukesh Ambani as the richest Asian person in February, became a centibillionaire in April, and outperformed Bill Gates and France’s Bernard Arnault in the past two months. It’s the first time somebody from Asia has highlighted this highly in the highest levels of the wealth index, which has been dominated by US tech entrepreneurs.

Adani, 60, dropped out of college to take a shot in Mumbai’s diamond industry in the mid-1980s prior to going to coal and ports. His combination has since expanded into everything from airports to data centers, cement, media, and green energy, focusing on regions that Prime Minister Narendra Modi considers critical to meeting India’s long-term economic goals.

As per the Bloomberg Billionaires Index, just $1 billion had isolated Jeff Bezos from Gautam Adani, the Indian billionaire and chairman of Adani Group, an industrial conglomerate.

Jeff Bezos’ fortune was then esteemed at $150 billion in this ranking, while Adani’s was assessed at $149 billion.

Since the monstrous fortune of the two men rests principally in the shares each holds in his particular organization, the sure thing was that Adani would surpass Jeff Bezos before the day’s over.

The country’s biggest private-sector port and airport operators, city-gas distributors, and coal miners are all part of Gautam Adani’s empire, which additionally aims to become the world’s biggest renewable-energy producer. Last year, it promised to invest $70 billion in green power, a pivot that has been criticized by some as greenwashing given that such a great deal of the group’s revenue actually comes from fossil fuels.

The push into renewables and infrastructure has procured Gautam Adani investments from firms including Warburg Pincus and TotalEnergies SE, helping support his organizations’ shares and his personal fortune. This year, he added about $70 billion to his riches — more than any other individual — while many have seen losses.

The fast expansion of Adani’s combination provoked Fitch Group unit CreditSights to portray some of the organizations’ influence as “elevated” in a September report. The group has said its firms have reduced debt levels in recent years.

The scrutiny is adding to previously existing concerns over opaque shareholder structures and an absence of expert coverage. A few Adani Gathering organizations have traded at 700 times earnings, far surpassing firms like Tesla Inc. and Amazon, whose valuations have been more like 100 times.

Gautam Adani’s rise coincides with a tech selloff that has shaved more than $45 billion from Jeff Bezos’ fortune since January. The net worth of the Amazon founder — for years the world’s richest person — likewise fundamentally dropped after his 2019 divorce from ex-wife MacKenzie Scott, who got 4% of the e-commerce monster.

The Indian mogul, who has promised to donate $7.7 billion for social causes, has likewise had the option to climb the wealth ranking because a considerable lot of the tech entrepreneurs at the top — like Gates — have supported their charitable giving.

Jeff Bezos has committed $10 billion to battle climate change and has given cash to the Smithsonian National Air and Space Museum.

Gates and Warren Buffett, some of the top philanthropists, began the Giving Pledge initiative in 2010 to assist with facilitating a developing inequality gap. The Microsoft Corp. co-founder said in July he was moving $20 billion to the Bill and Melinda Gates Foundation, which has likewise gotten more than $35 billion from Buffett.

The current volatility in the markets – – because of fears about the health of the economy notwithstanding an aggressive rate hike by the Federal Reserve to battle inflation – – is especially weighing on technology groups like Amazon.

Amazon stock is down around 26% since January. This converts into a drop in Jeff Bezos’ fortune, which has contracted by $45.5 billion this year.

Gautam Adani’s Meteoric Rise

On the other hand, Gautam Adani is experiencing a meteoric rise. His fortune has expanded by $70.3 billion since January.

His comrade, Mukesh Ambani, ranked 10th richest person in the world with an expected fortune of $88.7 billion, was the other top 10 billionaire to have seen his fortune increment (+$1.02 billion) this year until Sept.15. However, the next day, Ambani, who is chairman and managing director of the Reliance Industries conglomerate, lost of his benefits. He’s presently somewhere around $1.3 billion.

Toward the start of the year, Gautam Adani became the richest person in Asia, in front of Ambani.

The rest of the top 10 is likewise in the red.

The fortune of Musk, the richest man in the world, has contracted by $6.44 billion to $264 billion.

Bernard Arnault, chairman and CEO of LVMH, (LVMUY) lost $40.2 billion to $138 billion.

Bill Gates’s fortune is down $26.6 billion to $112 billion.

Warren Buffett’s (BRK.A) (BRK.B) is down $12.7 billion to $96.2 billion.

Alphabet (GOOGL) Co-Founder Larry Page has seen his fortune drop by $33.7 billion to $94.7 billion. Sergey Brin, the other co-founder of Alphabet, lost $32.9 billion to $90.6 billion.

Larry Ellison (ORCL) saw his fortune drop from $18.1 billion to $89 billion.

Since becoming the third richest man in the world in August, Gautam Adani has seen his fortune increment by $12 billion, while Jeff Bezos has lost $3 billion.

The ascent of Gautam Adani started during the Coronavirus pandemic. In March 2020, his net wealth was valued at more than $6 billion. From that point forward, his fortune has expanded by a factor of very nearly 25.

Considering that increment, likewise not feasible by the end of the year, Adani could surpass Musk as the richest person.

A Conglomerate Worked with Obligation

Gautam Adani, 60, isn’t notable in the West.

Born in 1962 in Ahmedabad in western India, Gautam Adani comes from a modest family of seven children whose father was a small textile merchant.

A self-made executive, Gautam Adani began working at age 16 at the diamond dealer Mahendra Brothers, where he was liable for arranging valuable stones.

In 1988 he established a commodity trading firm that would become the Adani conglomerate.

He has developed the group by procuring organizations with debt. Adani group has become the most significant organization in India. The organization holds mines, ports, and power plants; it owns a dozen commercial ports and is available in coal, electricity, and renewable energy. It additionally has enhanced airports, data centers, and defense.

Gautam Adani group additionally recently entered the cement sector by purchasing resources from cement manufacturer Holcim (HCMLY) in India and is likewise hoping to set up an aluminum factory.

Adani Enterprises is the flagship of his empire. In 2021, its turnover was $5.3 billion.

On Aug. 23, the CreditSights subsidiary of Fitch Ratings cautioned that the conglomerate was “deeply overleveraged” and may “in the worst-case scenario” spiral into a debt trap.

In any case, after two weeks the credit-rating firm said it found that it had made “calculation errors” in two of Gautam Adani Group’s organizations. It remedied its report and eliminated the words “deeply overleveraged.”

“CreditSights’ perspectives have not transformed from its original report we actually keep up with that the group’s influence is raised,” CreditSights finished up.

-

Sports4 weeks ago

Sports4 weeks agoAl Ahly vs Inter Miami, 2025 FIFA Club World Cup – Preview, Prediction, Predicted Lineups and How to Watch

-

Health3 weeks ago

Back to Roots: Ayurveda Offers Natural Cure for Common Hair Woes

-

Tech3 weeks ago

Tech3 weeks agoFrom Soil to Silicon: The Rise of Agriculture AI and Drone Innovations in 2025

-

Startup4 weeks ago

Startup4 weeks agoHow Instagram Is Driving Global Social Media Marketing Trends

-

Sports3 weeks ago

Sports3 weeks agoFIBA 3×3 World Cup 2025: Full Schedule, Preview, and How to Watch

-

Science4 days ago

Science4 days agoJuly Full Moon 2025: Everything You Should Need to Know, When and Where to See Buck Moon

-

Gadget3 weeks ago

Gadget3 weeks agoThings to Know about Samsung Galaxy S26: What’s New and What’s Next

-

Sports4 weeks ago

Sports4 weeks agoWorld Judo Championships 2025: Full Schedule, Date, Time, Key Athletes and How to Watch