Real Estate

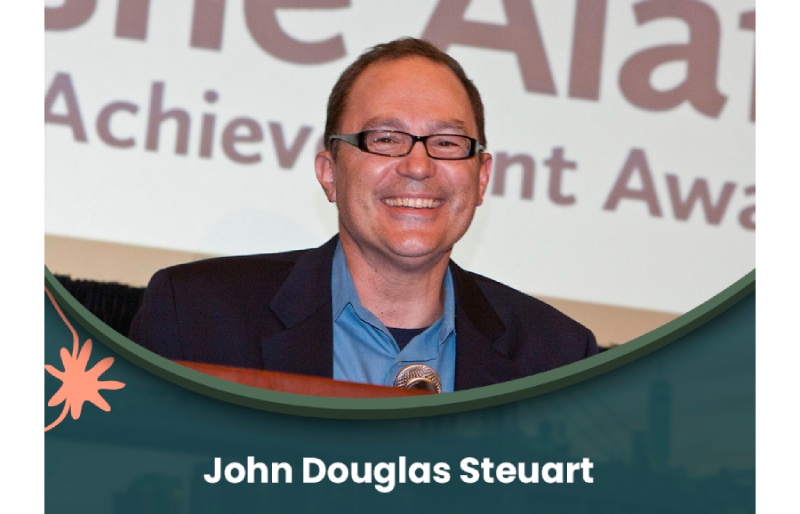

John Douglas Steuart Discusses the Pros and Cons of Investing in Real Estate

John Douglas Steuart is a seasoned investor that has continued to invest in a variety of asset classes. At the same time, he has offered insight into what could make something a good investment. One alternative investment that many people consider is investing in real estate. Similar to any other type of investment, there are pros and cons that come with real estate investments. Steuart offers insight into what some of these risks and opportunities can be.

Pro – Real Estate Will Always Be in Demand

One of the advantages of investing in real estate is that it will always be in demand. Owning a rental property can be a good idea as people will always need to have a place to live. If you are able to find a home that is located in a good area, there will always be people in the area that will need to rent. While demand and rental rates can fluctuate, the need for housing should always provide you with a good chance of keeping your home leased.

Pro – Great Way to Build Equity

Investing in real estate is also a good way to build equity. Investors such as John Steuart will always be concerned about the long-term value that real estate ownership provides. When you invest in real estate, you can build equity in numerous ways. This can be done by collecting rental income and earning money on a monthly basis, slowly paying down your mortgage, and seeing the property increase in value over the years. Over a long period of time, these benefits add up to lead to a significant amount of equity creation.

Con – Not a Liquid Investment

One of the risks of investing in real estate that you should be aware of is that it is not a liquid investment. Real estate should be considered a long-term investment that you are willing to hold through various cycles. If you want to purchase and sell it quickly, you can find that it will take longer than you expected, and there are hefty fees that come with selling a property.

Con – Susceptible to Market Swings

While real estate tends to go up over the long run, it is susceptible to market swings. Both micro and macro factors can influence the value of real estate. Due to this, there is a chance that the value of your asset can decline. However, if you hold it long enough, the markets typically rebound, and you should also build equity by slowly paying down your mortgage balance.

If you are looking for a good investment, putting your money into a rental property can be a great option. John Steuart and other investors continue to find that real estate offers various opportunities that can make it a good option. It is important that you properly evaluate the pros and cons of real estate investing to determine if it is a good idea for you.

-

Tech1 week ago

Tech1 week agoAdobe Releases New AI-powered Video Editing Tools for Premiere and After Effects with Significant Motion Design Updates

-

Sports4 weeks ago

Sports4 weeks agoUnited Cup 2026: Full Schedule, Fixtures, Format, Key Players, Groups, Teams, Where and How to Watch Live

-

Book4 weeks ago

Book4 weeks agoAuthor, Fighter, Builder: How Alan Santana Uses His Life Story to Empower the Next Generation Through UNPROTECTED

-

Health4 weeks ago

Health4 weeks agoNew Research and Treatments in Motor Neurone Disease

-

Science4 weeks ago

Science4 weeks agoJanuary Full Moon 2026: Everything You Should Need to Know, When and Where to See Wolf Supermoon

-

Entertainment4 weeks ago

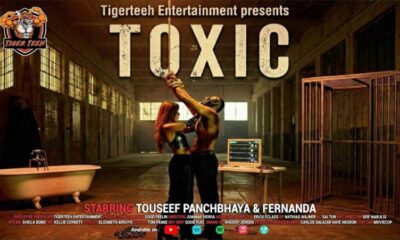

Entertainment4 weeks agoTigerteeh aka Touseef Panchbhaya Drops His Latest Hindi Track “Toxic”

-

Business2 weeks ago

Business2 weeks agoSpartan Capital Publishes 2026 Economic Outlook, Highlighting Volatility, Resilience, and Emerging Opportunities

-

Startup3 weeks ago

Startup3 weeks agoCraig Bonn’s Guide for Spotting a Winning Pre-IPO Early