Business

GameStop looks for a share split during renewed meme-stock hype

Video game retailer GameStop Corp (GME.N) said on Thursday it would seek investor endorsement for a stock split, expecting to turn into the most recent U.S. company to make it more straightforward for retail investors to own its shares.

The move comes after retail investor interest in alleged ‘meme-stocks’ erupted over the most recent two weeks, prompting a multiplying in GameStop’s share price cost to $166.58. A stock split makes shares more reasonable for individual financial backers by bringing down the cost, without influencing the company’s valuation.

A few financial backers are betting that the stock split will boost the worth of GameStop by drawing in more meme-stock enthusiasts. The association’s portions hopped 19% in late-night exchanging on Thursday after the company announced the move.

In the past two years, Apple (AAPL.O), Nvidia (NVDA.O), and Tesla (TSLA.O) have split their shares, while Amazon (AMZN.O) and Google-parent Alphabet (GOOGL.O) have as of late declared impending share parts.

On Monday, Tesla Inc’s (TSLA.O) market capitalization hopped by more than $80 billion after the electric vehicle creator said it would look for financial backer approval to indeed expand the number of its portions to empower a future stock split, without saying when that split could happen.

Meme-stocks are intensely shorted shares that are broken up by retail financial backers via virtual entertainment stages, for example, Reddit is fully intent on crushing out multifaceted investments betting against them. The trend overwhelmed Wall Street in January 2021 and gradually buzz throughout the span of the year.

GameStop plans to expand its number of extraordinary Class A typical offers to 1 billion from 300 million, it said in a document. The company will likewise request that investors vote on a motivating force plan “to help future compensatory value issuances”, it added.

The date and area of the company’s annual investors’ meeting have not yet been reported.

Extremely rich person Ryan Cohen, who is the chairman of GameStop’s board, revealed recently that his speculation company bought 100,000 shares of the game retailer. The buy took Cohen’s complete holding for 11.9%.

Cohen’s work to turn GameStop around after he joined the company last year by putting resources into its stores and online business and acquiring new abilities still can’t seem to create significant outcomes.

The company earlier announced a total deficit of $147.5 million for the three months finishing January, the first holiday season misfortune in quite a while history. The retailer has been trying to win back gamers who currently go to online streaming or other outlets.

GameStop’s money balance might erode “relatively quickly” except if the company becomes profit-making soon, Wedbush examiners cautioned recently.

-

Education3 weeks ago

Education3 weeks agoBelfast AI Training Provider Future Business Academy Reaches Milestone of 1,000 Businesses Trained

-

Tech4 weeks ago

Tech4 weeks agoJonathan Amoia’s Insights on the Intoxication of Artificial Intelligence

-

Sports3 weeks ago

Sports3 weeks agoUnited Cup 2026: Full Schedule, Fixtures, Format, Key Players, Groups, Teams, Where and How to Watch Live

-

Health4 weeks ago

Health4 weeks agoTolga Horoz: How Developing an Interest in How People Solve Problems Shapes Better Thinking and Innovation

-

Cryptocurrency4 weeks ago

Cryptocurrency4 weeks agoWhen Crypto Markets Calm Down: How NB HASH Builds Stable Passive Income Through AI Computing Power

-

Book2 weeks ago

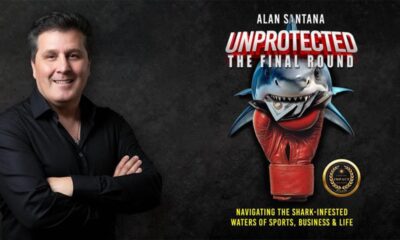

Book2 weeks agoAuthor, Fighter, Builder: How Alan Santana Uses His Life Story to Empower the Next Generation Through UNPROTECTED

-

Health3 weeks ago

Health3 weeks agoNew Research and Treatments in Motor Neurone Disease

-

Science3 weeks ago

Science3 weeks agoJanuary Full Moon 2026: Everything You Should Need to Know, When and Where to See Wolf Supermoon