News

Reasons to Think Again Before Following Stock Tips From Social Media

Social media has grown in importance as a communication tool for the majority of people during the past ten years. And since 2020 in particular, the investing community has made use of social media’s rapidity and extensive reach to share breaking news and trending tips with one another. However, as investors might have assumed, those popular tips aren’t actually that helpful.

Evidence has been uncovered by European Union finance experts that refutes the myth that following stock investing tips on social media will result in enormous profits. According to researchers, there isn’t much proof that social media can produce long-term profits, even though they might help spot the odd one-day spike.

There are no significant stock market gains from social media

This week, a research report outlining the relationship—or lack thereof—between social media stock tips and investment returns was released by a committee of researchers affiliated with the European Securities & Markets Authority of the EU.

The researchers discovered a discernible rise in the volume of social media conversations about the stock market since 2021. This started around the time of the infamous GameStop stock scandal, in which retail investors made a coordinated effort to invest a large amount of the company’s stock.

This resulted in a significant increase in GameStop’s share price. There was a brief squeeze as a result. The stock saw a surge in share price as traders, particularly those at hedge funds, were compelled to liquidate their short positions to prevent additional losses. The worldwide attention garnered by the social media-driven endeavor culminated in the Hollywood production, “Dumb Money.”

The trend of using social media to share stock tips persisted even after the “meme stock” frenzy subsided.

On the one hand, the study discovered a link between short-term excess returns and these stock mentions on social media, “suggesting that information spreading on social media platforms influences investor trading choices and may amplify short-term financial market movements,” the report stated.

The data also reveals that these stock tips are generally ineffective at generating significant long-term gains. Positive social media interactions have a roughly one-day duration on stock prices. According to research, the social media hype surrounding a stock can cause instant price pumps for shares. This is probably because investors see a positive sentiment and jump on the bandwagon, which increases trading volume and may short-term push prices higher.

These recommendations, however, don’t translate into any appreciable long-term returns, so growth investors shouldn’t take them seriously.

One important conclusion drawn by the authors is that social media sentiment is unreliable and unvetted, in contrast to specialized financial media sources. Therefore, investors need to consider the fact that many of these recommendations from social media are false or misleading, in addition to the fact that stock tips do not always result in significant long-term success.

As a result, there is even greater risk involved in making investments based on social media sentiment.

-

Business3 weeks ago

Business3 weeks agoCorporate Social Responsibility in Action: Amerilodge’s Support of Health and Education Causes

-

Business3 weeks ago

Business3 weeks agoWhere There Is a Will, There Is a Way: Hayson Tasher and the New Year, New Me Mindset in Security Entrepreneurship

-

Health2 weeks ago

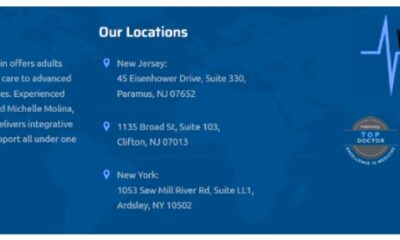

Health2 weeks agoMy Juno Health Enterprise Partnerships Signal Shift From Claims Management to Utilization Prevention

-

Business2 weeks ago

Business2 weeks agoAlain Khoueiry and His Mission to Present Kazakhstan as a Land of Opportunity and Wonder

-

Health4 weeks ago

Health4 weeks agoLeg Numbness and Tingling: Vein vs Nerve Causes

-

Music3 weeks ago

Music3 weeks agoBTS will Return With ‘BTS THE COMEBACK LIVE | ARIRANG’ Concert and New Documentary on Netflix

-

Health1 week ago

Health1 week agoShame, Trauma, and the Mind-Body Connection: How Dr. Karina Menali’s Kai Wellness Frames Emotional Healing as Integral to Physical Health

-

Apps3 weeks ago

Apps3 weeks agoBest Apps with Simple IPO Application Process