Lifestyle

The Lifestyle Ladder: A Financial Guide to Climbing to Your Best Life

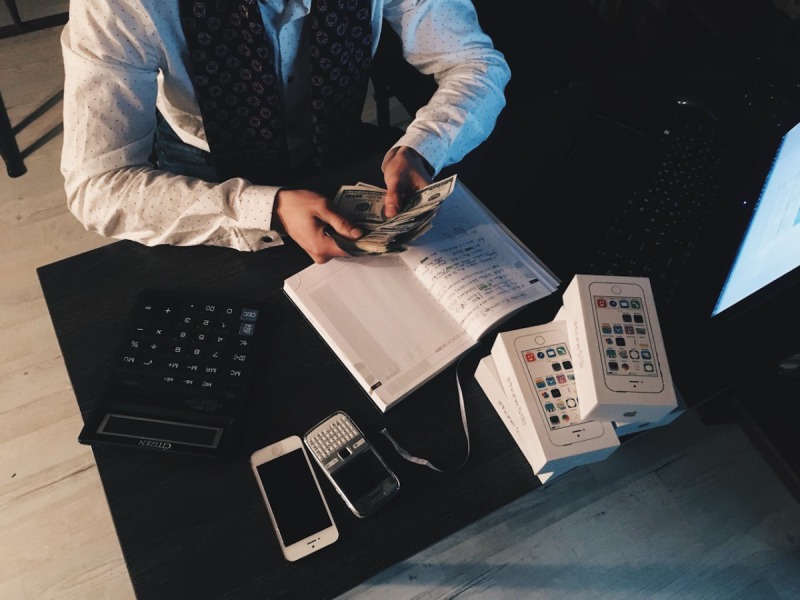

Most people dream of living their best life, but few know how to get there. Your vision might include financial freedom, travel, early retirement, or just less stress. To build a lifestyle that supports these goals, you need to plan and use smart money strategies. The “Lifestyle Ladder” helps you see your financial journey as a series of steps. Each step brings you closer to the life you want.

Step 1: Build a Strong Foundation

To climb, you need a stable base. This means you must master the basics of personal finance: budgeting, saving, and managing debt. Begin by tracking your income and expenses to grasp where your money goes. Make a budget that puts essentials first, includes savings, and leaves some room to enjoy life.

You must have emergency savings. Try to put aside three to six months of living expenses in a savings account with high yields. This buffer protects you from sudden setbacks and gives you the nerve to take smart risks down the road. If you owe money at high interest rates, like credit card balances, focus on paying it off. You can then use the money you save on interest for investments or to upgrade your lifestyle.

Step 2: Boost Your Income Sources

After you’ve built a strong base, your next move is to increase your earnings. This can happen through job promotions, starting a side business, or putting money into assets that generate income. The aim is to create several income streams so you don’t rely on just one paycheck.

Think about making money from your talents through freelance jobs giving advice, or selling digital goods. Income sources that don’t need constant work, like stocks that pay dividends, properties you rent out, or royalties, can also help you climb the financial ladder. As you earn more, don’t start spending more right away. Instead of buying a new car or clothes, put the extra cash into assets that will grow over time.

Step 3: Make Smart Investments

Investing puts your money to work for you. Begin with retirement accounts such as a 401(k) or IRA if your employer matches your contributions. After that, check out taxable brokerage accounts to give yourself more options.

Spread your investments across stocks, bonds real estate, and other assets. Get to know the basics of how to divide up your assets and how much risk you’re comfortable with to create a portfolio that fits what you want to achieve. If you’re not sure how to get started, you might want to team up with a financial advisor or try out robo-advisors for automated help.

This is also the stage where you might check out more hands-on approaches, like Forex day trading. This involves buying and selling currency pairs on the same day. It can lead to quick gains, but you need self-control, skills in technical analysis, and a solid plan to manage risks. It’s not for everyone, but people who like fast choices and market study might find it useful in a mixed money plan.

Step 4: Improve Your Lifestyle

As your financial situation gets more stable, you can start to shape your life on purpose. This means spending in line with what matters to you. If you love to travel, set aside money for regular trips. If health is your top concern, put money into good food, fitness, and wellness.

Time becomes more precious at this point. You can hire others to do tasks that wear you out, like cleaning or office work, so you can concentrate on what’s important. You might also think about cutting back your work hours or switching to remote or freelance jobs for more freedom.

Now’s also a good chance to look at your money goals again. Are you putting money aside for a house getting ready for kids, or aiming to retire? Change your plan to match what matters to you now.

Step 5: Leave Your Mark and Make a Difference

The last rung on the lifestyle ladder focuses on leaving a lasting mark. When you’ve met your money needs and fine-tuned your way of life, you can turn your attention to giving back and making a difference. This might involve donating to charity, guiding others, or starting a company that matches your beliefs.

At this point, planning your estate becomes key. Ensure your assets have protection and your wishes are on paper. Think about setting up trusts drafting a will, and talking about your plans with your family. You might also want to put money into causes you care about, through charity work, investments that create change, or offering your time. Living your best life means helping others do the same.

Conclusion

Moving up in life takes planned effort. You begin by getting good at the basics then work your way up to being money-smart, happy with yourself, and making a real difference. No matter where you are on this path – just starting or halfway there – each step gets you closer to the life you want. If you stay focused, plan well, and know what you’re after, the life you dream of isn’t just a wish – it’s something you can reach.

-

Sports4 weeks ago

Sports4 weeks agoAFC Champions League Two 2025-26: Full Schedule, Fixtures, Date, Time, Venue and List of Matches

-

Business4 weeks ago

Business4 weeks agoSacred Office Spaces and Energetic Profitability: How Shamanism Enhances Business Culture and Removes Obstacles to Profitability

-

Gadget4 weeks ago

Gadget4 weeks agoFITUEYES Set to Redefine Your TV Room at IFA Berlin 2025

-

Business4 weeks ago

Business4 weeks agoBeyond the Numbers: Earl Fenner Illustrates What True P&L Ownership Looks Like in a High-Stakes Industry

-

Science4 weeks ago

Science4 weeks ago3 Stunning Star Clusters to Watch in Mid-August Skies

-

Book3 weeks ago

Book3 weeks agoCelebrating Hindi with words and vision: Dr Kumar Vishwas recites poetry for Power Grid Corporation of India Limited in New Delhi

-

Apps4 weeks ago

Apps4 weeks agoHow and Where to Find the Schedule Call Feature on WhatsApp

-

Apps3 weeks ago

Apps3 weeks agoSpotify Launches “Messages” Feature for Sharing Music, Podcasts, and Audiobooks