Business

The Compliance Engine: How Black Banx Navigates Global Regulations

In today’s complex global financial landscape, where innovation can outpace oversight, only a handful of institutions can scale across borders without stumbling over regulatory tripwires.

Black Banx, a global digital banking platform now serving 78 million clients in over 180 countries, is one of them. It has done more than merely comply—it has embedded regulation into the core of its business model, turning a traditional cost center into a strategic growth engine.

With regulatory pressure tightening across jurisdictions, particularly in areas like data privacy, anti-money laundering (AML), and crypto oversight, Black Banx has architected a compliance system that is as dynamic and scalable as its global ambitions.

Global Footprint, Hyper-Localized Compliance

Black Banx’s expansion strategy is tightly interwoven with its regulatory intelligence. By aligning its operations with jurisdiction-specific requirements and maintaining localized compliance teams, the platform ensures seamless integration into the legal frameworks of every country it enters.

This localization includes:

- Adapting onboarding flows to meet specific KYC/AML regulations

- Maintaining country-specific licensing and reporting structures

- Operating regional subsidiaries or banking partners where local presence is mandatory

Whether onboarding a user in Kenya or processing a transaction from Germany, Black Banx ensures that regulatory fidelity never slows down customer experience.

Smart Onboarding: Instant, Yet Compliant

Black Banx offers instant account setup in 28 fiat currencies and 2 cryptocurrencies, thanks to a compliance engine that verifies user identity with speed and precision.

Its onboarding process includes:

- AI-based document verification and facial recognition

- Risk profiling based on behavioral and geographic data

- Real-time AML scoring and continuous monitoring

This process enables users—from freelancers to global businesses—to access banking services in minutes, all while meeting international regulatory standards.

Transaction Monitoring at Scale

Processing millions of daily transactions across borders and currencies requires not just automation, but intelligence. Black Banx’s compliance engine integrates:

- Machine learning algorithms that flag suspicious patterns such as structuring or layering

- Behavioral analytics to detect fraud attempts and financial crime

- Real-time cross-referencing with sanctions and embargo lists

- Automated filing of Suspicious Activity Reports (SARs) with relevant authorities

This ensures Black Banx remains proactively compliant in regions with high-risk financial environments—without sacrificing transaction speed or user trust.

Crypto With Control

In Q1 2025, 20% of Black Banx’s total transactions were in crypto, highlighting the platform’s growing dominance in digital asset banking. But regulatory scrutiny in crypto is intense—and Black Banx has responded with an equally intense compliance model.

The platform supports Bitcoin and Ethereum wallets, exchanges, and transfers—but under strict safeguards:

- Blockchain analytics to trace source of funds and wallet legitimacy

- KYC/AML enforcement for all crypto-fiat conversions

- Compliance with the FATF Travel Rule to share transaction information between financial institutions

- Geo-blocking for users from high-risk jurisdictions or those under sanctions

This hybrid model lets users take advantage of crypto’s flexibility while staying fully within regulatory boundaries.

Automated Global Reporting

Regulatory reporting—whether for tax, financial crimes, or data privacy—is non-negotiable. Black Banx automates this burden through its integrated reporting engine:

- Real-time audit logs for internal and external reviews

- Full FATCA and CRS compliance for tax transparency

- Jurisdiction-specific reports for AML agencies, central banks, and tax authorities

- Transparent systems that regulators can trust—and clients can verify

This capability not only enhances regulatory trust but provides shareholder confidence as Black Banx continues its rapid growth.

Compliance Culture from the Inside Out

The strength of Black Banx’s compliance doesn’t come from software alone—it’s embedded in its corporate DNA:

- Dedicated compliance officers in every major operating region

- Ongoing compliance training for all employees, regardless of role

- Periodic third-party audits to test and improve frameworks

- Continuous risk assessments, even in seemingly low-risk regions

This proactive approach positions Black Banx not as a company that reacts to regulations, but as one that anticipates them.

Backed by Results

Black Banx’s commitment to compliance hasn’t slowed growth—it’s fueled it. In Q1 2025 alone, the bank:

- Grew from 69 million to 78 million customers

- Processed billions in international transfers across 180 countries

- Posted a pre-tax profit of $1.6 billion, more than double Q1 2024’s figure

- Maintained a cost/income ratio of 63% while expanding regulatory infrastructure

These numbers reflect not just operational excellence, but a trusted regulatory reputation that unlocks new markets and fuels investor confidence.

Compliance Is the New Catalyst

Black Banx understands that in today’s world, trust isn’t won with glossy apps or fast transactions alone. It’s built through transparency, security, and regulatory fidelity.

By investing in scalable, tech-driven compliance systems and embedding them deeply into its global operations, Black Banx hasn’t just built a safer financial platform—it has set the standard for what global banking should look like.

The future of finance doesn’t belong to the fastest—it belongs to the most trusted.

And Black Banx is earning that trust, regulation by regulation.

-

Sports4 weeks ago

Sports4 weeks agoUnited Cup 2026: Full Schedule, Fixtures, Format, Key Players, Groups, Teams, Where and How to Watch Live

-

Tech1 week ago

Tech1 week agoAdobe Releases New AI-powered Video Editing Tools for Premiere and After Effects with Significant Motion Design Updates

-

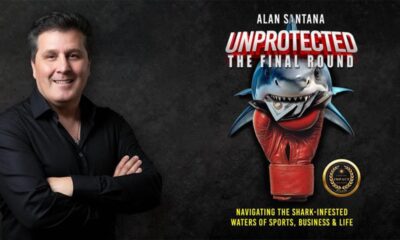

Book3 weeks ago

Book3 weeks agoAuthor, Fighter, Builder: How Alan Santana Uses His Life Story to Empower the Next Generation Through UNPROTECTED

-

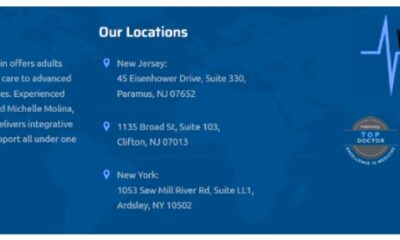

Health4 weeks ago

Health4 weeks agoNew Research and Treatments in Motor Neurone Disease

-

Science4 weeks ago

Science4 weeks agoJanuary Full Moon 2026: Everything You Should Need to Know, When and Where to See Wolf Supermoon

-

Entertainment4 weeks ago

Entertainment4 weeks agoTigerteeh aka Touseef Panchbhaya Drops His Latest Hindi Track “Toxic”

-

Business2 weeks ago

Business2 weeks agoSpartan Capital Publishes 2026 Economic Outlook, Highlighting Volatility, Resilience, and Emerging Opportunities

-

Startup3 weeks ago

Startup3 weeks agoCraig Bonn’s Guide for Spotting a Winning Pre-IPO Early